Veep Launches Gh Dual Card

Vice President Dr Mahamudu Bawumia, has launched what has been described as the world’s first dual-purpose EMV and financial inclusion payment card in Accra.

Vice President Dr Mahamudu Bawumia, has launched what has been described as the world’s first dual-purpose EMV and financial inclusion payment card in Accra.

Known as the Gh Dual Card, the new product, being rolled out by the Ghana Interbank Payment and Settlement Systems Limited (GhIPSS), is a two-in-one payment card that has both the e-zwich and gh-link applications. It can therefore be used either as e-zwich, gh-link or both as desired on payment platforms.

According to officials of GhIPSS, the card has been designed to give cardholders access to both funds on their e-zwich cards and in their bank accounts at the same time, and seeks to eliminate the inconvenience that comes with carrying multiple Cards.

The card can be used by cardholders for any point of sale purchase across merchant locations; ATM cash withdrawals; ATM PIN change; and Balance Enquiry. Thus, any customer who has an e-zwich card and also owns a bank account can opt for a Gh Dual Card instead of two separate cards.

Speaking at the launch ceremony on Wednesday, 7th August, 2019, Vice President Bawumia celebrated the strides Ghana continues to make in the quest for greater financial inclusion, in order to ensure holistic national development.

“We have in the past two years seen a convergence towards electronic based services as a country and it is a deliberate policy by His Excellency President Nana Addo Dankwa Akufo-Addo, to use technology to drive efficiency as we grow the economy and move Ghana beyond aid. Many a time we tend to look at what other countries are doing without recognizing the great strides we are making.

“Today, thanks to the hard work of GhIPSS and partner institutions such as the banks, Telcos and Fintechs, financial inclusion and intermediation has improved significantly. Ghanaians can now move funds seamlessly across the various payment platforms: mobile wallets, e-zwich wallets and bank accounts.

“This dual card is part of the payment system architecture that we are putting in place. What we are launching today, which is the dual e-zwich card and gh-link card, is a world first; its not happened anywhere in the world. It is the first time that any country in the world is issuing this combined EMV card and a financial inclusion card. It is remarkable, and will further promote financial inclusion in Ghana.

“In the payment systems space, and I’m not shy about saying this, it is clear that Ghana is now the undisputed leader in Africa.”

Vice President Bawumia continued,

“There is no doubt that Ghana's Interoperable platforms have improved significantly our National Financial Inclusion drive. It has served well the financially excluded and underserved. Now, practically, everyone has access to basic banking services. Many people have been roped into the formal banking environment by virtue of the convenience created by the interoperability and people are accessing credit as well as investing through their mobile phones.

“With where we have gotten to as a country and the passage of the Payment Systems and Services Act, which the President has assented to, the sky is no longer the limit.”

Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) is set to launch a bank card which has the functionalities of an e-zwich and gh-link card on Wednesday.

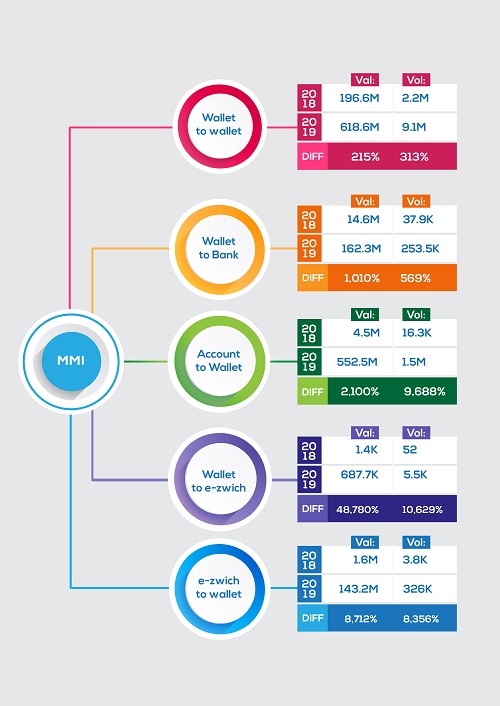

Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) is set to launch a bank card which has the functionalities of an e-zwich and gh-link card on Wednesday. Just a year after its launch, Mobile Money Interoperability—a system that makes mobile money transactions among different networks possible—has hit GH¢95.88million in value for the first quarter of 2019, the Payment Systems Statistics report published by the Ghana Interbank Payment and Settlement Systems (GhIPSS) has revealed.

Just a year after its launch, Mobile Money Interoperability—a system that makes mobile money transactions among different networks possible—has hit GH¢95.88million in value for the first quarter of 2019, the Payment Systems Statistics report published by the Ghana Interbank Payment and Settlement Systems (GhIPSS) has revealed.

Mobile Money Interoperability (MMI) recorded more than 4.4 million transactions in its first year of operation. Beginning with just 96,907 transactions in its first month, public usage of the cross-network platform grew phenomenally to 422,275 transactions in December last year and 502,873 transactions in May this year.

Mobile Money Interoperability (MMI) recorded more than 4.4 million transactions in its first year of operation. Beginning with just 96,907 transactions in its first month, public usage of the cross-network platform grew phenomenally to 422,275 transactions in December last year and 502,873 transactions in May this year.